Trust us; we’re good for it

Minnesota’s mining regulators at the Land and Minerals Division of the Department of Natural Resources face a stiff test of fidelity to the citizens of Minnesota as described in an article by Josephine Marcotty in the Strib’s paper edition on May 14th. The issue is: what are the financial reserves that must be set aside to assure the state that PolyMet’s proposed mine will be cleaned up and closed properly, maintenance free, with no losses to the state?

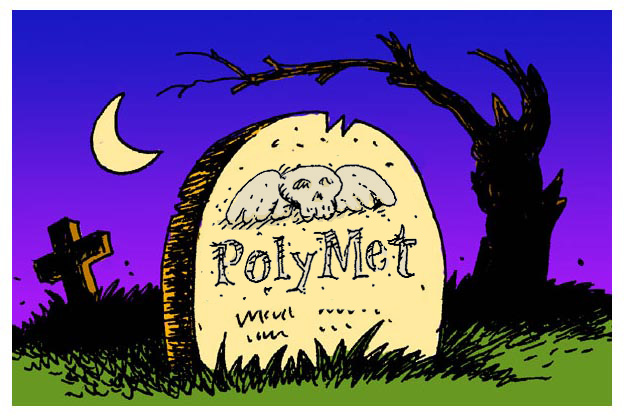

Two sets of experts have looked at the cost of pre-planning PolyMet Mining Corp.’s funeral, so to speak, and the numbers are grim. The state’s own retained experts say it’s in the neighborhood of $650 million, while an independent expert, who delivered a presentation at the University of Minnesota recently, said it was more like $934 million, up front. That is just shy of a billion dollars, people. That is three or four times PolyMet’s market capitalization, let alone book value.

Characteristically, PolyMet’s spokesman, Brad Moore — a former DNR and MPCA employee, by the way — says, Trust us; we’re good for it:

Brad Moore, PolyMet’s vice president for governmental affairs, said small and large mining companies can and do find ways to fund financial assurance packages and project construction. PolyMet is in the process of doing that now, he said.

Really what he said was, We don’t have the money.

As it stands right now, of course, even the car salesman from Crown couldn’t get these guys a loan to buy a used car. PolyMet isn’t bankable, and its prospects for raising money in the stock market are dim, too, because its stock is playing the limbo:

PolyMet 5 year stock chart

Understand that sums for financial assurances are in addition to those needed to construct and operate the mine.

The article suggests that the issue of financial assurances presents a balancing test: too little and the state is not protected, too much and the mine won’t be built. It has to be just right!

The DNR, though, is charged with determining what it costs to protect the state, to provide for cleanup, and to leave the site clean and maintenance free. It is not charged with deciding how much of the state’s patrimony of clean water it is willing to trade to open a mine.

PolyMet protests that it will leave the site clean as a whistle. If it does, it will be the first time in sulfide mining history that a mining company did. “A mine is a hole in the ground with a liar standing next to it,” is a quote attributed to Mark Twain.

Even the closed Flambeau mine in Wisconsin, touted by the industry as the Grotto of the Miracle of the Immaculate Extraction (okay, my term) is leeching toxic heavy metals into the ground water.

You can read about that, and PolyMet’s finances, and how miners’ hopes and dreams have a way of turning into Super Fund sites at the many LeftMN stories written about PolyMet. Most of them are pretty good, a few not so good, and a couple are pure dreck, but you will have to read them all to figure out which is which. Get started now, because there are a lot of them.

You will read that the aforementioned Brad Moore, at a Minnesota House hearing in 2014, defended PolyMet, saying, “We are a real company.” It was sort of like your ten-year-old son telling you, “I am a real man.” It’s charming, but it’s not really true.

At the beginning of the story, I wrote that “mining regulators at the Land and Minerals Division of the Department of Natural Resources face a stiff test of fidelity.” I also wrote that Brad Moore, a former executive at the DNR, is now a senior executive at PolyMet. I wrote a story once about the exit of Minnesota regulators to the industries they once regulated, but I can’t find it at the moment. Perhaps you can find it in the stories linked above.

I will tell you quite directly that I think that the Land and Minerals Division of the DNR is entirely captured by the industry it is supposed to regulate, and that it needs to be watched very, very carefully. Our state auditor, Rebecca Otto, summed it up pretty well:

Update: Well, I didn’t write the story about the revolving door, my former website colleague, Aaron Klemz, did. Here it is.

Further update: The Mount Polley mining disaster from a couple of years ago, in all of its horror story glory, is the best cautionary tale for what the Land and Minerals Division is playing with here. You can read a LeftMN story about it at Hiring more dingoes as babysitters.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.