When the going gets tough

The senior mining companies take a powder

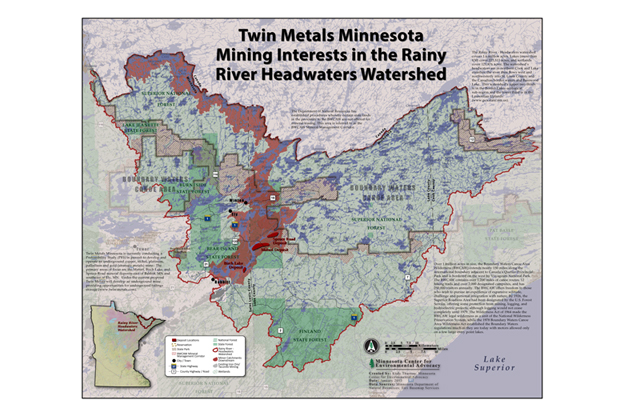

It was announced in recent days that Chilean mining giant Antofagasta PLC, the big mining company to little mining company Duluth Metals, doesn’t want to take its relationship to the next level. The announcement came on the eve of the publication of a Pre-Feasibility Technical Report on Twin Metals’ mineral holdings next door to the Boundary Waters Canoe Area Wilderness.

A suspicious person might conclude the events were related.

But Duluth Metals, taking over the management of the joint venture, says it is as happy as it can be. To infinity and beyond! Right.

What happened was, Antofagasta PLC, “ANTO” to its friends, decided that it didn’t want to ratchet up its interest in the Twin Metals joint venture into majority ownership. It just isn’t that into Twin Metals, or the other joint venture partner, Duluth Metals, any more.

But it rather leaves the Duluth Metals (which, despite its name, is actually headquartered in Toronto, Canada) in the lurch, with about $12 million Canadian in the bank, and about $38 million Canadian in liabilities. And a burn rate that will eat $12 million in no time. Duluth Metals, and the joint venture, are as liquid as a brick.

Here’s the key, though to our friend ANTO’s thinking:

Twin Metals, our project based in Minnesota, in the United States remains on track for completion of the pre-feasibility study during this year. The project has significant reserves and is a world class deposit in terms of size. It also faces technical and environmental challenges which we believe will be overcome, but not until at least the end of this decade.

In other words, We don’t see the upside.

Duluth Metals, the junior mining company partner here, now must find another suitor or well, die. It isn’t bankable on it own. It couldn’t borrow the money to buy a used car.

Now, while this is excellent news for the Boundary Waters, wild rice, fish, and water everywhere, it is also an important lesson for consideration by regulators, and the public, of the current proposal by PolyMet Mining and its largest shareholder, commodities giant and international bad boy, Glencore PLC.

Why?

This is the lede that got buried 350 words [actually more, as it is turning out] into the story.

You will recall that PolyMet recently published a Supplemental Environmental Impact statement for the giant sulfurous hole in the ground it wants to dig near Hoyt Lakes; well that, and the Great Sulphur Mountain it wants to build next door. And I almost forgot the Great Sulphur Lake (the tailings “pond”) that is part of this resort development, too.

Presently, the DNR and other regulators are busy with front-end loaders dealing with the comments received to the SEIS, the vast majority of which were negative, many intensely negative, and unfortunately for PolyMet, rather technical.

Friends joins EPA, 50,000+ other public comments on #PolyMet mine plan | Friends of the Boundary Waters Wilderness http://t.co/DwR3wpJDtD

— Friends of the BWCAW (@FriendsBWCAW) March 26, 2014

But when they make their way through the comments, if they ever do, one of the giant-yawning-maw issues not so far addressed in a meaningful way is the financial assurances to be made for when (and not if) PolyMet makes a dog’s breakfast of the whole thing and pollutes our Minnesota patrimony of clean water.

PolyMet is just as creditworthy as Duluth Metals. Which is to say, it isn’t. Every time PolyMet runs out of money, it goes, hat in hand to Glencore, which gives it a little, in exchange for another pound of PolyMet flesh. The last time it happened was April of this year.

Brad Moore, the Executive Song and Dance Man for Polymet, said recently and memorably, “We’re a real company!” (At a House hearing on financial assurances this past session.)

Yes, and I’m Louis the Sun King.

PolyMet, the Canadian high-plains drifter parent of the subsidiary that owns the mining rights in Minnesota, was incorporated in 1981. Guess how much money it has earned since its formation? Guess how many mines of any kind it has ever operated?

The answer to both questions is the same. Zero, zip, zilch, nada. But that astute investor and distaff side of Team Naif for Governor is a believer:

First time tour for a long-time shareholder. pic.twitter.com/RWqMvNkJGa

— Karin Housley (@KarinHousley) June 23, 2014

Jeebus, Karin, you need better financial advisers. Maybe Scott can give you a referral.

On the plus side, PolyMet probably has a tax net loss carryforward to the moon, Karin. These are the things on which dreams are built.

[Update: That PolyMet headquarters building behind Housley is really impressive, isn’t it? The air conditioner hanging out of the window (must be the president’s office) is an especially nice touch. You have to wonder what Housley toured: the curling linoleum and the gray metal filing cabinets? The only other thing she might have toured was the shuttered grinding plant (“Karin the big rocks come in here, and the little rocks go out there.” PolyMet bought the processing plant out of the bankruptcy of a taconite mining company with, you guessed it, Glencore’s money.]

Given the dissolute nature of the thirty-three-year old ne’er-do-well PolyMet, and given the evidence of the faithless nature of the senior mining companies in general, you’d think that the regulators at the DNR would be screaming and demanding a guarantee of the environmental liability obligations of PolyMet by Glencore, wouldn’t you?

Well, my friends, you’d be sadly mistaken if you thought that. At the hearing on financial assurances in the Minnesota House last session that I mentioned earlier, representatives from the Minnesota Department of Natural Resources said they would not seek guarantys of environmental liability obligations from shareholders of PolyMet, even a large shareholder like Glencore, which is in practical control of PolyMet.

You can bet your bottom dollar that the moment that Glencore decides, We don’t see the upside, that the State of Minnesota, its citizens, its environment, and even PolyMet, itself, will be holding a potentially very large bag. That is an especial concern when the mine closes, in say twenty years, and there is no more revenue coming from it.

If this is the best deal that the DNR can manage, it is staffed either by callow fools, or in the words of John Oliver, dingos as babysitters.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.