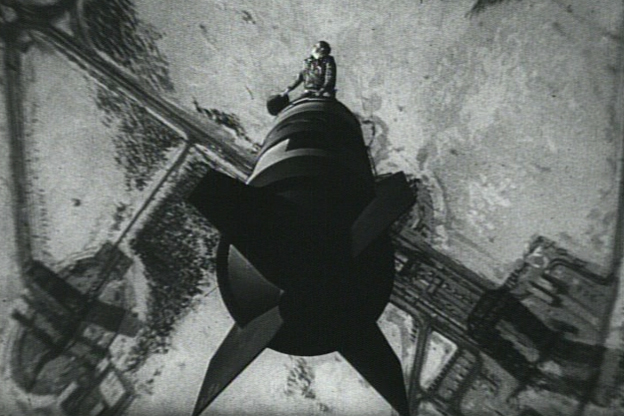

Rangers ride the Bomb

I was unaware of the decision making that went into the IRRRB and DEED’s pouring of over a half million dollars into the rathole known as Duluth Metals. But John Myers wrote a story of this tale of investment woe that appeared in the Duluth News Tribune on January 31st, and you ought to read it. It is quite a good story about the inner workings of a somewhat obscure agency — at least off the Iron Range — the IRRRB.

The IRRRB is almost panting with desire over copper sulfide mining in northern Minnesota. Well, skip the “almost.” Its board members are eight Iron Range legislators, plus one more state senator, also usually a Ranger, appointed by the Subcommittee on Subcommittees (I am not making that up)*. The Subcommittee on Subcommittees is a subcommittee of the Rules Committee. Gee, that was fun to write.

The IRRRB also has an executive, the Commissioner, who until recently was Tony Sertich; he resigned recently and was replaced by Mark Phillips, who will figure more in this tale later. Phillips is a former DEED Commissioner and the Director of Economic Development for the IRRRB.

It has been my experience that economic development types have to be watched especially carefully.

– o O o –

The nine members of the IRRRB are really the emirs of northern Minnesota. Instead of paying ad valorem property taxes, operating mining companies pay a “production tax” that is levied per ton of ore mined. The money is collected by the state, not the counties where the mines are located. And it isn’t distributed strictly where a mine is located either. There is a statutory formula for distributing the the taxes collected to cities, townships, counties, and school boards in something called the Taconite Assistance Area.

In addition to the entities mentioned above, a nice slice of the pie is given over to the emirs of northern Minnesota to dole out, more or less as they see fit. As you might imagine, this makes the emirs pretty popular.

If you want to promote Hockey Day in Minnesota, repair the Grand Rapids showboat, if you are the Range Area Municipalities and Schools and you want to develop a new model for learning ($180K in the last report), or you are Detroit Diesel, Delta Airlines, or an established mining company and you want to expand, why, the IRRRB is the place for you. You won’t get all the money you need from the IRRRB, but it will chip in.

And this was news to me, but the IRRRB seems really into demolishing houses and garages. Scraping lots so builders don’t have to. If you read the report at the link above, you’ll see that the outlay by the IRRRB in the most recent accounting period was $21 million dollars, in round numbers.

The emirs really understand their clout. Last fall, David Dill, a representative from Crane Lake, threatened Grand Marais if it didn’t get on board with sulfide mining.

– o O o –

But that’s not all. In addition, the IRRRB also manages two other funds (maybe more, who knows?; these are the ones I know about). One is the Douglas J. Johnson Economic Protection Trust Fund, or as I call it, the “Doug Fund,” named after a former Range senator who is now a lobbyist for, inter alia, Twin Metals, really Antofagasta Plc.

The second one is the Taconite Environmental Protection Fund. The fund is not a “trust,” so I suppose that the IRRRB is merely a steward of this money, not a trustee. (Although really I don’t think there is any difference in the responsibility of the IRRRB for either fund.)

Both of these funds also receive production tax money. But it’s the second one that was involved in the IRRRB’s little stock market play.

– o O o –

You wouldn’t think that a fund called the Taconite Environmental Protection Fund would be involved in investing in start up mining ventures, would you? Well, I wouldn’t, but it’s one of the wonderful things about the Emirate of Northern Minnesota.

I only took about 675 words to get to the point this time, so you will have to agree that I am getting better.

There is another document that I want you to read. It’s the minutes of a meeting of the IRRRB where it decided, along with Minnesota’s DEED, to exercise warrants (stock options) in a company called Franconia Minerals, a predecessor in interest to Duluth Metals. As part of some financing to Franconia, some five years earlier, (again: why is a fund with environmental protection in its name lending money to development stage companies?) the TEPF and DEED got some warrants as a spiff.

Duluth Metals, a Canadian concern, with its impending joint venture marriage with Antofagasta Plc., a joint venture named Twin Metals, was poised to acquire the stock of Franconia, and the warrants to the IRRRB and DEED were assigned as part of the deal.

So, what to do? Wait and exercise the warrants until after the Franconia stock purchase was done? The IRRRB understood at some primitive level that Duluth Metals was not, um, blue chip. If the exercise took place after the purchase by Duluth Metals, the state would have to hold the stock for at least six months before selling, and the stock price could go down. The stock was enjoying a bump because of the pending joint venture.

IRRRB and DEED could sell the warrants, but a broker would probably want a big cut.

Third, exercise the warrants immediately. And that’s what they did. The IRRRB and DEED each paid a quarter of a million for Duluth Metals stock.

There was just one teeny problem: the state was investing in the development stage Duluth Metals, not Antofagasta Plc.

It’s as if a banker made a car loan to an unemployed sixteen year old kid without getting the guaranty of mom and dad. (Well, not exactly the same, but you get the idea.) It’s an oversight that came back to bite.

Even though there was no guarantee that Antofagasta Plc. would stick with Duluth Metals and the joint venture Twin Metals, the IRRRB and DEED did not sell the stock right away and take its profit. (They were undoubted urged not to by Duluth Metals because of the negative publicity it would generate.)

Instead, they rode that sucker right into the ground.

The charming Anto decided it just wasn’t that into Duluth/Twin Metals anymore and declined to make any additional investment in Twin Metals. Duluth Metals stock tanked instantly, because it was recognized that it was a smoking crater.

And irony of ironies, the buyer for the smoking crater was Antofagasta Plc.

In the Duluth News Tribune article linked at the top of this story, Mark Phillips said, Hey getting warrants is really smart. We should do it more.

Yeah, Mark it’s smart, but not when the warrants are for a bag of beans.

* Update: Really, I was making it up. A reader asked, with a sense of wonder — and a little suspicion, I think — if there was such a committee. It’s really the Subcommittee on Committees, which is a subcommittee of the Rules Committee.

I regret the error. It’s still Kafka.

Further update: In case you missed it in the story, in addition to the IRRRB money, the State of Minnesota, through DEED, also has a quarter million dollars in ashes in this smoking crater.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.