Mining Truth: about those jobs, jobs, jobs (Part 4)

Proponents of the proposals to develop copper-nickel sulfide mines in northern Minnesota love to talk about job creation. Beyond the puffed up promises of direct job creation, the terms “spinoff,” “indirect,” and “induced” jobs are used to inflate the job creation potential of proposed mines. The theory goes that a new job puts money in the pocket of the new employee, who will then go out and spend it in the community, creating new jobs for other folks as grocers, real estate agents, car dealers, and piano teachers. This often fuels wildly optimistic predictions of the local economic impact of sulfide mine proposals.

Usually, when politicians get going, they really like to play this card. For example, Rep. Chip Cravaack talks about thousands of high wage jobs being created by sulfide mining projects. While we can excuse a little hyperbole, looking at the track record of an actual community helps suss out the actual impact on a local economy.

This post looks at the effect on local income of opening a new copper mine in Safford, Arizona in 2006. You can read more of the story of Safford in a previous post that looked at the impact of opening an new mine in 2006 on employment and unemployment in Safford. Earlier posts in this series discussed the match between job creation promises and performance, and the labor history of Arizona’s copper mines and what that might portend for proposals to mine copper and nickel from the sulfide ores of northeastern Minnesota.

Income increases, earnings stagnate

One claim frequently made by mining supporters in Minnesota is that high wage mining jobs will add to the income of the area. But the track record in Safford suggests that we should be skeptical that increasing income dependence on the mining sector will increase the income of an area. In fact, Safford provides a case study of two trends. First, Safford has had a long-term stagnation in inflation-adjusted earnings, despite the presence of a large number of mining jobs and opening a new mine in 2006. Second, Safford has seen a significant increase in income, but nearly all of the increased income has come from increased transfer payments from the government.

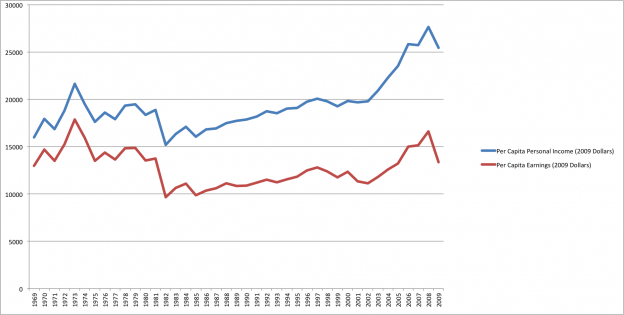

This chart shows two lines. The blue one on the top shows a significant increase in per capita area income from 1969 to 2009. Over that 40 year period, per capita income grew from near $15,000 to over $25,000 in inflation adjusted dollars, an increase of over 70%. It looks like an economic success story for mining, but a closer look at the numbers suggests otherwise.

First, note when the spikes (up and down) in each line occurred. Real earnings peaked in 1973, at the height of a commodities boom, and again in 2008 at the height of another commodities boom. As the price of copper goes, so goes the local economy. This has the reverse effect in bad times. In 1982, as mines closed and as the disastrous Phelps Dodge strike eviscerated the Steelworkers union, earnings and income plummeted. The economic downturn and concomitant copper price collapse in 2008-9 had a similar effect.

The red line on the bottom is per capita earnings in inflation adjusted dollars. Over the same 40 year period, earnings in Safford have remained virtually flat. What’s happening?

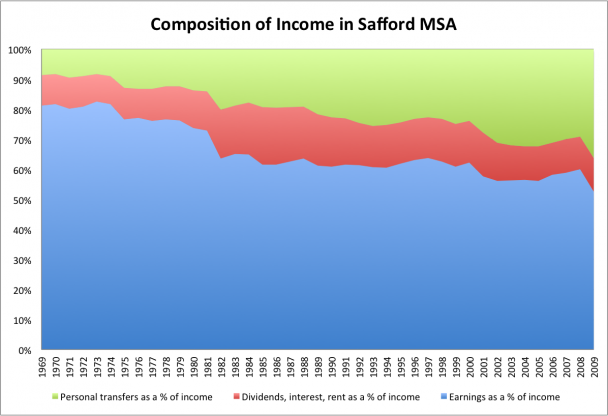

The answer is that the amount of personal transfers as a percentage of income increased dramatically over the same 40 year period. In 1969, wages were 81% of income in the Safford MSA. In 2009, wages were less than 53% of income, an all-time low. There was a dramatic drop in the proportion of wages in 2009 due to layoffs and a significant increase in the amount of transfer receipts.

Personal transfers are income derived from Social Security, private pensions, unemployment insurance, and income support payments like TANF. Most of that comes from government programs. In part, this can be explained as the consequence of an aging population, and in part from significant increases in unemployment insurance after big layoffs in 2008. But this also reveals a long-term shift in this mining-dominated economy that opening a new mine in 2006 did not forestall. Earnings continue a long term stagnation, despite the opening of the Safford mine in 2006.

Even at the height of the boom from construction and new mining jobs in 2008, the portion of income derived from earnings (60%) was no higher than in 2000 or 1990. This demonstrates a long-standing trend that an increase in mine employment did little to forestall. The health of the Safford economy and the income of Safford’s residents is tied more to transfer payments than to earnings.

The implication for people considering the economic impact of opening a proposed copper-nickel mine like PolyMet is that economic diversification is better for the long-term health of northeastern Minnesota’s economy than increasing dependence on mining. Safford’s long-term earnings stagnation is in part the reflection of a broader national trend, but also shows that mining alone cannot sustain the local economy. Even the short-term boost to earnings provided by the temporary construction jobs building the mine quickly evaporated.

In my next post, I’ll look at the impact of opening the Safford mine on population and area business income.

Follow me on Twitter @aaronklemz

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.