Mining Truth: About those jobs, jobs, jobs (Part 3)

Representative Chip Cravaack, Iron Range DFL politicians, and local boosters of sulfide mining projects proposed by PolyMet and Twin Metals portray new mines as an economic panacea for beleaguered northeastern Minnesota. But promises are different than performance. The real economic picture is much more murky.

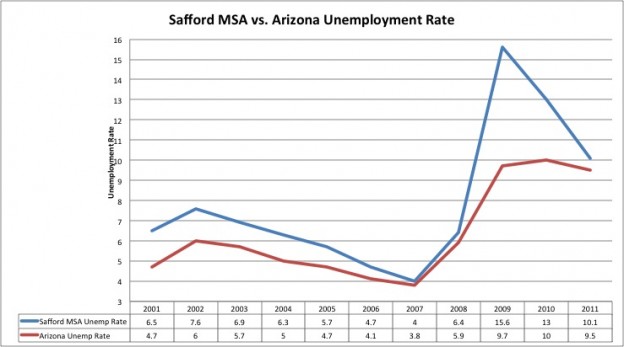

The most comparable example of a new copper mine opening in the United States over the past two decades, the Safford Mine in Arizona, demonstrates the complicated economic effects of opening a new mine in a traditional mining district. The bottom line is that opening a new mine can increase both employment and unemployment. How? The short-term boom of building a mine comes with both economic benefits and significant costs, and the long-term effect is an increase in the volatility in the local economy. The Safford mine, opened in 2007, was far from a source of stability during our most recent economic downturn. Instead, the increased dependence on mining caused a quadrupling in unemployment at the bottom of the recession.

In Part One of this series, I looked at the ever-shifting promises of direct job creation from copper-nickel mine proposals in northeastern Minnesota. In Part Two, I examined the labor history of the copper mining industry in the United States, including the Morenci strike of 1983 that crushed the Steelworkers union in Arizona. In Parts Three and Four of this series, I’ll examine the effects of constructing and opening the Safford Mine in Arizona on the economy of Graham and Greenlee counties in southeastern Arizona. This post looks at the effect of the Safford mine on employment and unemployment. Part Four will examine the impact of opening the Safford mine on the population, wages, and business income of the area.

The Safford area and the Safford mine

Similar to the Iron Range, the Safford area is an area that has risen and fallen with the mining industry. Graham and Greenlee counties are rural areas far removed from urban centers, with a high percentage of land owned by the U.S. federal government. They have a long mining history, dating back to the 1880s. The Morenci mine in Greenlee County, is one of the oldest and largest copper mines in the U.S., employs over 2,000 workers. The Safford area population is aging and growing very slowly, in contrast to the booming populations in other parts of Arizona.

The U.S. Office of Management and Budget treats Graham and Greenlee counties as the Safford Micropolitan Statistical Area, since there is high degree of economic integration between the counties. The opening of a new mine should be reflected in the economic data of the MSA.

Safford mine is touted as the largest new copper mine opened in the U.S. in the last thirty years. This mine was over fifty years in the making, with discovery of the ore body by prospectors in 1957, and drilling and exploration in the 1960’s and 1970’s to develop an underground mine. The plans for an underground mine were suspended in 1982. In the 1990’s exploration and development resumed, this time with an eye toward developing an open pit mine. Phelps Dodge began the permit process in 1995, faced a difficult land exchange with the Bureau of Land Management (BLM), and a contentious dispute over water usage with the Bureau of Indian Affairs. In July 2004, the BLM signed off on the land exchange, clearing the way for permitting. Air quality permits were approved by the state of Arizona in July 2006. As copper prices skyrocketed in 2006, and with permits in hand, construction began.

The mine opens, the recession hits

In early 2008, at the height of a spike in copper prices, the Safford mine employed about 600 workers. But by the end of 2008, Safford’s employment demonstrated the volatility associated with the copper mining industry. As the financial crisis caused copper prices to crater, the layoffs began. On November 17, 2008, Freeport-McMoran laid off workers at all of its Arizona mines, including 402 pink slips at Morenci and 59 layoffs at Safford. As metal prices collapsed, Freeport-McMoran laid off over 145 workers at the Safford mine and hundreds more at the Morenci mine, a total of over 600 layoffs in November 2008, just over a year after the opening of the mine. At the lowest point of production in 2009, over 2,000 miners were laid off between the Morenci and Safford mines.

Increased copper prices in late 2009 and 2010 led Freeport-McMoran to rehire workers and the Safford and Morenci mines returned to robust production. At the beginning of 2011, Safford mine operated near full capacity, employing approximately 600 people.

Nonetheless, unemployment in the surrounding area remains stubbornly high. In part, this can be attributed to a poor overall economic climate. But even with the additional jobs from the Safford mine, the unemployment rate of Graham and Greenlee counties remains higher than the average for the state of Arizona.

The first five years of the Safford mine’s life provide a useful comparison to the economic benefits and challenges that proposed copper mines are likely to pose in northeastern Minnesota. After the opening of the Safford mine, the following occurred:

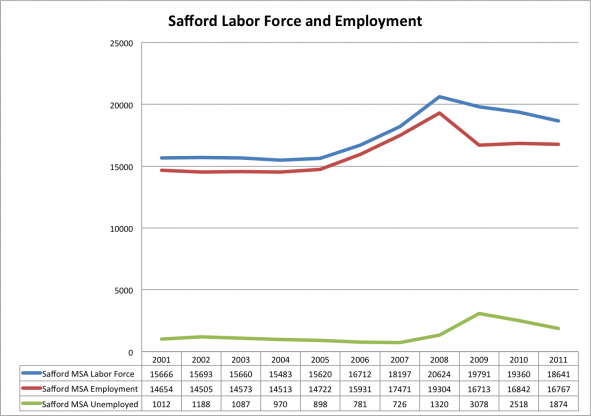

• A significant influx of workers into the area during construction. While the size of the workforce shrank when temporary jobs ended, it remained higher than before the opening of the Safford mine.

• The number of mining jobs increased, but layoffs made employment more volatile compared to the lower but steadier level of jobs before the opening of the Safford mine.

• The unemployment rate and number of unemployed workers in the area spiked. This has persisted through 2011, despite the fact that both Safford and nearby Morenci mine are at high levels of production. The unemployment rate in the Safford MSA remains higher than the Arizona average. During the height of the recession, the Safford mine didn’t reduce unemployment, it significantly increased it.

A March 28, 2009 article in the Arizona Republic summarized the effect on the local economy:

“We were in our own little bubble for a while,” said David Kincaid, city manager of Safford, 170 miles east of Phoenix, where in 2007 copper giant Freeport-McMoran Copper & Gold Inc. opened a new mine. An unexpected drop in copper prices last fall prompted Freeport and other producers to cut operations and lay off thousands of workers. Now, Safford and neighboring towns are experiencing a reversal of fortunes. Occupancy at once-full hotels has been cut in half. Lunch and dinner crowds at restaurants have thinned. Local governments grapple with the double whammy of lower sales-tax revenue and cuts to state shared revenue.

Area residents are no strangers to the ups and downs. Employment levels at mines always have fluctuated with copper prices. “Anything that depends on the mining industry is either boom or bust,” said Tammy Mayhew, a hotel manager in Safford who has lived in the community since 1976. This time, cuts are deeper and laid-off workers face a tougher job market.”

Increased employment and increased unemployment

Safford has experienced, in a few short years, both sides of an employment boom and bust. The Safford MSA had a very stable workforce of approximately 15,600 workers from 2001 to 2005. Safford mine construction began in 2006, and the mine opened in late 2007. The construction phase and opening of the mine brought new jobs and an influx of population to the area. At the height of construction, up to 1,500 construction workers flooded into the area, straining housing and driving up rents. One-bedroom apartments that used to rent for $400 per month jumped to $900 per month. This also created business opportunities in Safford. Hotels were built, a Home Depot and a Wal-Mart Supercenter opened in town.

But as the temporary construction jobs ended and the mine laid off workers in late 2008, the workforce shrank. The number of people seeking work didn’t shrink as quickly as the available jobs, causing a spike in the unemployment rate. The influx of new workers and the strains placed on the local economy to accommodate rapid population growth caused the sudden loss of jobs to hit Safford particularly hard. The number of unemployed workers in the Safford MSA quadrupled from 2007 to 2009. In 2011, the number of unemployed workers in the Safford MSA remains more than twice that of 2007, despite the mines returning to robust production. Paradoxically, the opening of the Safford mine has increased both employment and unemployment in the surrounding region.

Keep in mind a couple of facts about Minnesota’s Iron Range and the proposal to open copper-nickel mines like PolyMet. First, the size of the Safford mine is significantly larger than the PolyMet proposal, but probably smaller than the Twin Metals mine. Second, the crash in Safford happened at the same time as the crash in taconite mine employment associated with the 2008-2009 financial crisis. Third, there isn’t a significant tourism industry in this area like there is in northeastern Minnesota. This means that Minnesota has more jobs to lose than Safford does.

There is much more to the story of Safford. I’ll look at the changes in population, wages, and business income that came in the wake of Safford’s boom and bust in the next installment of this series.

Follow me on Twitter @aaronklemz

(Charts derived from Arizona Office of Employment and Population Statistics, “Arizona Unemployment Statistics Program Special Unemployment Report,” accessed June 12, 2012.)

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.