Taxing Harry and Louise

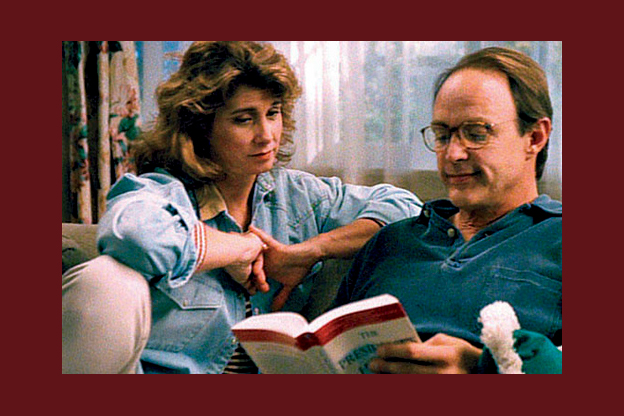

Republicans in Minnesota have already retreated to the fainting couch over the prospect of state income tax increases. I thought I would ask Harry and Louise, America’s favorite worried couple, to help me work through the implications of an income tax increase. And they were kind enough to agree. Thank you, Harry and Louise!

I happen to know that Harry and Louise have a Minnesota taxable income (more about taxable income later) of exactly $151,000, and that they file joint federal and state returns. How do I know this? Well, since they are a figment of the Republican imagination, they can make whatever I say they make, right? So, let’s see how the hard-pressed Harry and Louise do under some different scenarios.

Let’s first assume a new top marginal rate of 9% (which used to exist) that is applied to taxpayers with a joint taxable income in Minnesota of over $150,000; that’s a taxable income number that Governor Dayton discussed as the place to start with the higher rate during his campaign a couple of years ago.

So how much more do the hard-pressed Harry and Louise pay under this scenario?

$11.50.

Eleven dollars and fifty cents. That’s one Papa John’s pizza, without the Obamacare surcharge, of course.

What? That can’t be right!

Okay, let’s check the math. One thousand dollars of taxable income, taxed at the rate of 9% rather than 7.85%. The difference, for those of you keeping score at home, is 1.15%, and 1.15 times a thousand, divided by a hundred is, mirabile dictu, $11.50.

As King Banaian is my witness, I am not making this up.

The beauty of this little exercise is that it can be used a rule of thumb to evaluate a variety of proposals, viz.:

if the top marginal rates goes to 10%, the additional cost per $1,000 of taxable income over $150,000 is $21.50. (My God, you can’t get take out at D’Amico’s for $21.50.)

If the top rate goes to 11%? An additional $31.50 per thousand of taxable income over $150K. And so on.

And the calculation works for incomes over Harry and Louise’s hard-earned $151,000, too. Let’s say, just as an example, that the taxable income is $200,000, and the top rate — again over $150,000 of taxable income — is 9%. Additional tax? $11.50 times fifty, or $575.

Remember, this is a calculation based in Minnesota taxable income, not gross income. Gross income (the biggest number on your pay stub) will typically be significantly higher. Minnesota taxable income is based on federal taxable income. To arrive at federal taxable income, you subtract from gross income a number of items that you can read about at the link, but they include allowances for exemptions for dependents, some IRA and other retirement expenses, deductions for mortgage interest paid, charitable contributions, some capital losses, etc. For a family to have a taxable income of $150,000, it is fair to say that its gross income is probably $175,000 to $200,000, more or less, probably more.

Let’s say Harry and Louise are knocking down $175,000 gross to get to the $151,000 taxable. Eleven dollars and fifty cents extra doesn’t seem too onerous, does it? Or even $21.50 or $31.50.

But really, it isn’t even that much, because you get to deduct state income taxes paid in determining your federal taxable income. If you have a federal taxable income of $150,000, the feds will, in effect, pay about a third of any increase in state income taxes.

Just for good order’s sake, and for those of you who are interested, here are a couple of links:

Minnesota Department of Revenue – tax rates

Minnesota Taxpayers’ Association – calculation of Minnesota taxable income from federal taxable income

If Harry and Louise are prepared to leave Minnesota over these trivial, piddling incremental amounts, and move to a pesthole where they have to send their kids to private school, drive on even poorer roads than we presently have in Minnesota, and where the cities are turning out the lights and returning roads to gravel (and never mind they’ll have trouble making as much money), I say God bless ‘em and blow ‘em a kiss as they leave, because they’ll have much bigger problems than their tax bill.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.