The Pioneer Press shines a bright, unflattering light on HCPA

Please be sure to read the notes at the foot of the story.

There is a blockbuster story by Josh Vergas in the St. Paul Pioneer Press on Tuesday, September 21st. Some of you will remember reporting from earlier this summer by Vergas and by the Star Tribune about a five million dollar illegal investment in a hedge fund made by the superintendent of the Hmong College Prep Academy in late summer of 2019.

The super, Christianna Hang, exchanged some email with a hedge fund (?) called Woodstock Capital LLC, and several days later sent it a check for $5 million. I don’t know if Woodstock is a reference to the 1969 epic hippie festival or the little yellow bird pal of Snoopy; the latter would be more harmonic, given the location HCPA.

Prior to putting the check in the mail, Hang received a letter from counsel for HCPA, saying, For the love of God, don’t do this. Charmingly, the superintendent sent the letter to Woodstock — destroying the attorney-client privilege for the letter — and asked if they’d comply with it.

Depending on who you believe, Woodstock said either, Yeah, sure, no sweat, or, Are you crazy; we don’t know anything about Minnesota law. But either way, now the whole world knows about the advice, because Woodstock put it in the record in the litigation referred to in Vergas article.

It is also clear that the board of directors at the school, hand picked by Hang, knew about this illegal maneuver at least as early as its November ’19 board meeting. That’s apparently as far as it went until early summer of this year (’21) when the story broke in local media.

Where was the school’s authorizer, Bethel University, in all of this? Well, hold that thought.

HCPA had a big 2020. It raised a bunch of money to improve its campus by floating revenue bonds through the St. Paul HRA and the St. Paul Port Authority. It has raised about $60 million in bond financing, a significant portion of that in the 2020 round to finance the construction of a new middle school.

But nobody said boo, not the school, its board, its superintendent, or even its auditors accountants (see second note below) about a limited partnership investment in Woodstock Capital LLC. And amazingly, nobody at the HRA or Port Authority underwriters raised any questions and went ahead and issued the bonds without a mention of a clearly illegal act and investment by the school’s superintendent. Nobody said, Jeepers, who’s Woodstock Capital LLC there on your balance sheet?

Is this a problem? Well, hold that thought, too.

A couple of months after media poked it in the ribs and said that it better pay some attention this, late in August, this year, Bethel wrote a letter to the school and told it to clean up its act, and oh, by the way, terminate your superintendent.

But what does an authorizer do, exactly? You would think it would include reading board minutes and financial statements, each of which would have alerted Bethel to the, um, irregularity here, in the fall of 2019. Charter school authorizers are the principal source of oversight of charter schools.

Update 10/9: In the board minutes linked above Woodstock Capital Partners is identified as an “investment depository” for the school; the other two firms mentioned are banks. Interestingly enough, a representative of Baird & Co., the firm that did the principal underwriting of the bonds issued by the school in 2020 was at the meeting and made a presentation.

This explains, I think, why the authorizer Bethel is doing some backing and filling and trying to look like an, well, authorizer. It’s certainly looked pretty inept so far.

Why does the non-disclosure of this stinker investment matter? It covered up the rogue action of the school superintendent, and the fact that she is probably a financial lightweight. Ms. Hang is not only the superintendent: she is the chief financial officer. It covered up an illegal act under charter school law, and that act was certainly material to bond investors in their consideration of the competence of the management of the school. It covered up the fact that the authorizer was asleep at the switch.

HCPA is run like a proprietorship. One that gets tons of state money, in excess of twenty million dollars a year. Like all personality-driven enterprises, it will struggle without its founder. I think we’ve opened a new and ugly chapter in the life of HCPA.

– o O o –

It might be said of Bethel, What did they know, and when did they know it? Either they knew about this illegal investment in the fall of ’19, or they didn’t. Neither is a very good look for Bethel.

Bethel University is apparently the authorizer for multiple charter schools. I am not reassured by this whole business, and I don’t think you should be, either.

Just last spring, it was reported than another charter school, the Cedar Riverside Community School, collapsed under a decade of dysfunction. Where was its authorizer?

This is your future parents, when you send your children to schools that are overseen by the unelected and the unaccountable.

– o O o –

The bond offering described above became effective in early September of 2020. The offering document didn’t include audited financials, but only “preliminary” figures from the school’s accountants for the fiscal year ended June 30, 2020. Remember, the hedge fund “investment” was made early in that fiscal year, in late summer 2019.

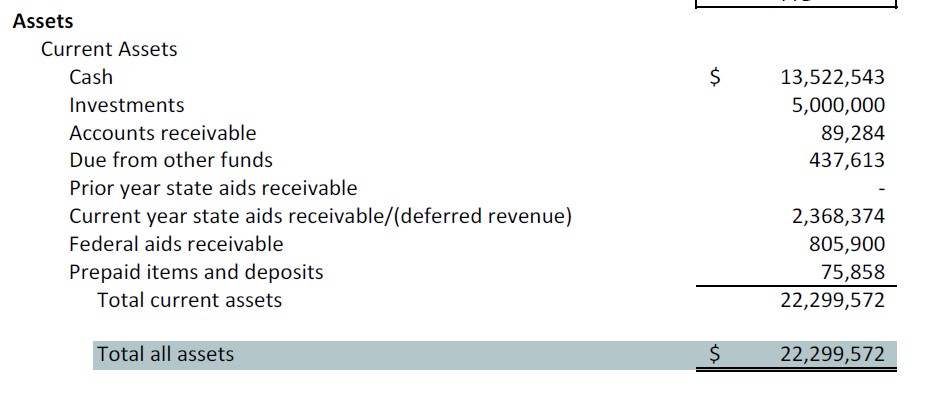

Here’s how the accountants described the Woodstock Limited Partnership interest:

Assets section of HCAP unaudited financial statement 6-30-2020

Note the “investments” of $5 million are listed as “current assets.” A current asset is one that is expected to be converted to cash within the company’s fiscal year. That wasn’t Woodstock. In fact, the word “Woodstock” doesn’t appear anywhere in any notes to the financial statements. Nor does the fact that the “investment” was illiquid and subject to the loss of principal. Which, of course, we and the bond holders found to be the case. Woodstock is the anthises of a current asset.

Remarkable to me, anyway, is the fact this all sailed right by the underwriters, the St. Paul HRA and Port Authority. They and the St. Paul city council accepted an undertaking from HCPA right before the bond offering went live, promising to provide audited financials.

By March of 2021, it hadn’t, and the bond trustee (the party that looks after the bondholders interests), U.S. Bank, sent a notice of default to HCPA.

HCPA responded with a whining the-dog-ate-my-homework reply saying it couldn’t get information from Woodstock to permit the auditors to close the audit.

The audited financial report for the period ended June 30, 2020 was finally issued in May, 2021. The audited financial report did mention Woodstock by name. Just shortly before media began to report on the fiasco. A coincidence? Not likely.

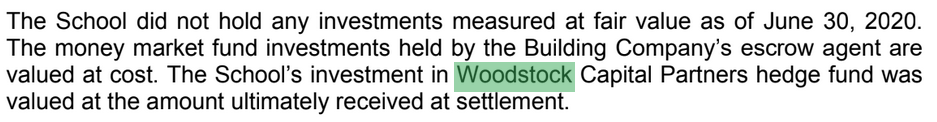

The school’s auditors said, Too Bad, So Sad, the school lost about $4.3 million dollars on a hedge fund investment. It didn’t say it that directly, but that’s what it meant. The audit report included this curious statement:

Auditors describe valuation of Woodstock investment

I don’t think that Woodstock settled anything. But notice that that Woodstock went from a current asset to a pile of oily rags. Poof! $4.3 million up in smoke.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.