Student loan default rife at Minnesota for-profit colleges

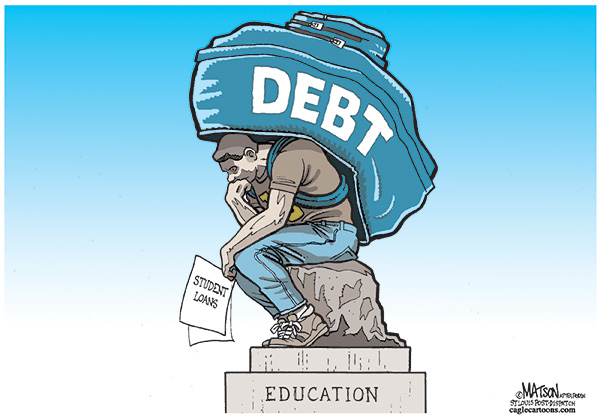

Last month’s release of “gainful employment rule” data from the U.S Department of Education shows student loan default reaching epidemic levels at Minnesota for-profit colleges. Despite a federal court ruling that struck down the application of these rules in July, the data gathered paints a startling picture of loan defaults in Minnesota and demands that Minnesota act to protect students.

These figures were released at the end of June by the U.S. Department of Education. There are three measures that all occupational programs at colleges and unversities must report:

1) Student Loan Repayment Rate for graduates (to pass, 35% or more need to be repaying their loans)

2) Debt to Earnings Ratio for graduates (to pass, the cost of repaying loans can’t exceed 12% of earnings)

3) Debt to Discretionary Income ratio for graduates (to pass, the cost of repaying loans can’t exceed 30% of disposable income)

At the time, the Minnesota media reported that only three programs in the state (all at Brown College) would have failed the GE test, which requires that a program fail all three of these measures. In addition, once the rule is fully implemented, a program will need to fail all three for three out of four consecutive years in order to be subject to sanctions. As a enforcement measure, this is incredibly weak. Despite this, a federal court judge declared that the 35% repayment rate was arbitrary. The Department of Education is refashioning the rules in a way that they think will pass muster.

Meanwhile, the data gathered are very useful at illustrating how badly for-profit colleges are serving their graduates. And that’s just their graduates, remember, these figures don’t include the impact on students who do not complete these programs. They are even worse off than those who complete a certificate or degree.

Let’s look at just one measure, student loan default rates. Here is a list of the fifty Minnesota for-profit college programs with a loan repayment rate of less than 50%. Some programs have fewer than 1 in 5 graduates that are successfully repaying their student loans. The very lenient gainful employment rule actually gives a program a “pass” if more than 35% of its graduates are successfully repaying their loans. By that measure, 15 for-profit college programs in Minnesota are failing. Many of these programs are the ones that you see advertised on the television, in fields like medical assisting, business, and law enforcement. (Note: the numbers in the spreadsheet below are the percentage of graduate who are successfully repaying their loans.)

When I say “Minnesota programs,” the programs listed above actually aren’t the whole picture. Some national chains report data in a way that makes it difficult to disaggregate Minnesota students. One significant Minnesota for-profit college, Everest Institute in Eagan, isn’t included. Technically, the Eagan campus is a branch of the Cross Lanes, West Virginia campus. Here are the default figures for students in the five programs that are listed on the Everest Institute’s Eagan campus website. All fail the 35% loan default threshold, but these figure commingle West Virginia students with Minnesota students.

Minnesota’s for-profit colleges are not very different from their counterparts across the nation who are increasingly under scrutiny for their recruitment practices, lack of transparency, high cost, low quality, and the huge amounts of debt with which they saddle their students. Nationwide, about 12% of college students attend for-profit colleges, but account for 25% of all student loans, and nearly half of all student loan dollars in default.

California has eliminated state grant eligibility for for-profit colleges that fail their students. Minnesota should follow suit. At a minimum, Minnesota should require that colleges receiving Minnesota State Grant funds disclose loan default rates and overall debt loads to their students.

Later this week, I’ll dive deeper into these figures and compare the overall debt load and repayment rates for similar programs at for-profit and public colleges.

Follow me on Twitter @aaronklemz

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.