Some Senate Democrats eagerly enabled the crypto bros

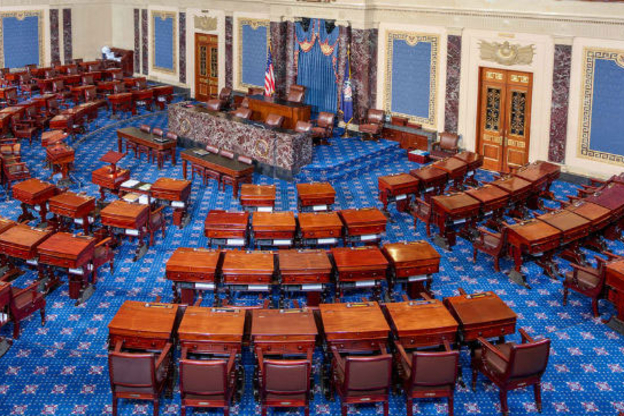

Yeah, this stuff.

It’s important to remember that crypto has not ever demonstrated any legitimate business use case at scale. Overwhelmingly, it is used for pure financial speculation and crime—both scams internal to the system like rug pulls, pump-and-dumps, and wash trading; also good old-fashioned robbery and/or money laundering by drug cartels, human traffickers, or North Korea. For any real business, crypto is worse than normal money in every way: less stable, less secure, and orders of magnitude more risky and expensive to use. Even several crypto-affiliated businesses that theoretically should have worked, like trading platforms making fees off crypto gamblers selling magic beans to each other, have turned out to be riddled with fraud and collapsed.

It follows that this crypto bill is just about the worst of all worlds. As Democratic staffers at the Senate Banking Committee point out, the regulatory protections are all but meaningless. The bill says that Consumer Financial Protection Bureau protections exist, but doesn’t explicitly grant it authority over the industry, or note that Trump has torn the guts out of the agency and is attempting to shut it down entirely. It says that stablecoins can’t have misleading names that suggest they are backed by the government, but carves out “USD,” which is what Trump’s and most of the big ones are called.

(The American Prospect)

This has a list of Democratic senators who voted for cloture. Regarding Minnesota’s, I knew that Tina Smith’s name wouldn’t be on there, because she’s generally good on issues, but I must say that I was pleasantly surprised not to see Amy Klobuchar’s either.

So, can crypto really crash the economy, or at least play a major role in doing so? When I first started looking for valid answers to those questions, I saw a lot of happy talk about how since it doesn’t have much to do with the real-world economy (yet), and banks aren’t betting big on it, the answer is “no” and don’t worry about it. It’s to be expected that you’d see a lot of that. US corporate media in general, and financial media in particular, are dominated in this country by giddy propagandists, cognitively ossified with market fundamentalism and mindlessly reflexive horror of anything supposedly tainted with “socialism” – that is, anything the parasitic greedheads who really largely run this country see as potentially threatening their wealth and power.

So I did more looking. And there does seem to be a general belief among legitimate researchers and analysts that the risks of crypto causing an overall economic crash at this time are low (though by no means zero), because it’s still pretty much a “closed system.” But it certainly seems to me that if it becomes less “closed” the risk will be considerably heightened. And it seems like the bill that will very likely soon be law, and which barely even pretends to keep the crypto bros properly leashed, is a very concerning big stride in that direction. Among other things I wonder whether banks will become more willing to gamble now that they have this superficial “regulation” as cover.

One last note: Crypto-Related Abductions Are on the Rise Globally

Comment from Joe Musich: What Lina Khan thinks of Kkkrypto.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.