If only PolyMet knew now what it knew then

One of the very best ways, my friends, to evaluate what someone says is to see what s/he said before. We’ll get into that in a moment, but first a brief reprise of things written here previously.

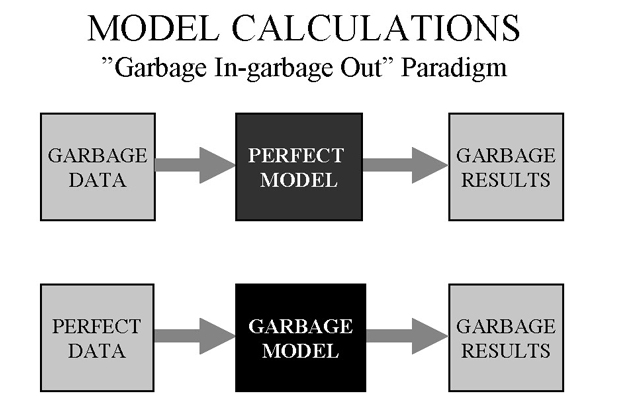

I have written before, on a couple of occasions, about PolyMet’s hopes and dreams for the flow of water — or perhaps lack of it — onto and off of its proposed mine, that is, its “water model.” A statistical model is supposed to, well, model or predict phenomena based on existing data. The most elegant model in the world is worthless if it isn’t based on adequate data, either their amount, or their accuracy.

It would be fair to say that the foundation of the PolyMet SEIS is the water model.

You cannot predict the outcomes of 200 or 500 coin tosses from a single toss. You could say it’ll probably be about fifty-fifty, but it wouldn’t be statistics.

In the judgment of a lot of people, including me, a centuries-long water model based on a single dry year’s data — especially when that data is wrong — is useless. Really, it’s worse than useless: it’s misleading.

Acknowledging recently, more or less, that its model is fatally flawed, PolyMet said we shouldn’t worry; it won’t know what’s in there until it digs it up, at all events, and besides, it has us covered financially.

So why not estimate how long water treatment would be needed? PolyMet officials said it’s very uncertain, and they say they won’t know enough about potential contaminants until they begin unearthing them and monitoring their impact.

“The real data will give us a much better idea of what the future looks like,” said Jennifer Saran, PolyMet’s director of environmental permitting and compliance.

She said estimating how long water treatment will be needed is beside the point because the company will offer financial guarantees to treat polluted water — forever if necessary.

“We’re prepared for treating the water for as long as it takes, and financially assuring the money that it would take to treat that water, and we know the treatment works to meet water quality standards so that the time frame is not really something that we have to know,” she said.

So, back to the premise stated above. Let’s evaluate what PolyMet says now based on what it said before. Now, when the defense of the model is untenable, it says, Don’t worry about the model; we don’t know what is down there, anyway.

But I think the permitting people ought to talk to the people charged with raising money from the public; they seem to have a really good idea of what is in the ground. Here’s the then.

Edison Investment Research Limited

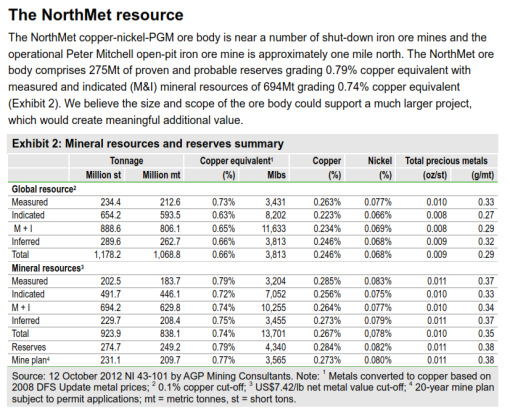

Edison Investment Research Limited touts stock for, among others, PolyMet Mining. This is from a report issued last fall. You see, if you want to invest money in PolyMet, it will tell you exactly what is in the ground — the valuable stuff, anyway. (N.B. 99%+ of the stuff is not valuable; it is waste rock that will wind up on Brimstone Mountain or in an already leaky tailings basin.)

But I guess PolyMet didn’t keep track of the sulfide rock. Pity. It is pretty remarkable, though, that the stock touters know more about what is in the ground than the permit appliers do.

Of course, that isn’t really true. I hope by now you are beginning to appreciate that PolyMet speaks a little extemporaneously at times and is capable of some, um, embroidery, as well.

And it isn’t the first time, either. Last November, KARE-11 asked some questions about the effective controlling shareholder, and sole sugar daddy (other than the IRRRB, that great rebater of mining production taxes to the mining companies), of junior mining company PolyMet: Glencore/Xstrata. PolyMet issued a press release saying that it had no control over who bought its shares on the open market, making it sound as though Glencore/Xstrata was a perfect stranger.

But a simple resort to PolyMet’s financial statements gives the lie to that one. Glencore acquired its shares in PolyMet in a series of private transactions, not in a public market; it has an agreement for board seats on PolyMet, and Glencore is, for all practical purposes, PolyMet’s only lender. Glencore has a first lien security interest in everything PolyMet owns.

PolyMet is Glencore/Xstratra’s puppet on a string.

When Jennifer Saran says that PolyMet will be around forever, if necessary, to treat the water, she’s making a promise that PolyMet cannot keep. PolyMet’s — the shell for whom Jennifer Saran is employed — days are already numbered. Once the mine closes, it’s a liability that nobody — least of all the real party in interest, Glencore/Xstrata — wants.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.