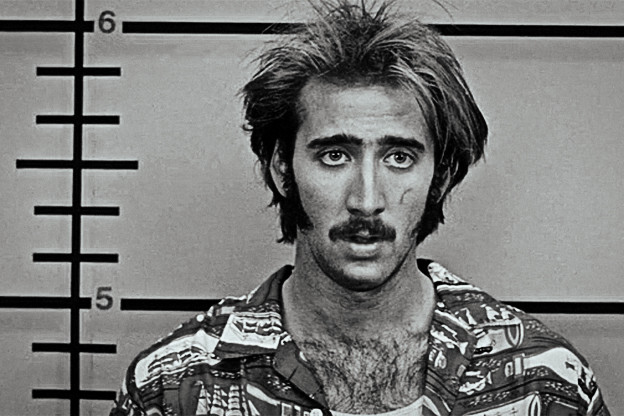

The ne’er-do-well brother-in-law

Most families have one: he needs just a little more help to make a go of whatever he’s up to — the 3.2 bar with futons for furniture, or whatever — or a place to crash when it doesn’t. And you can never do enough for him, either, because, well, he’s family. Everyone has an assigned role to play in these little tragedies, and often play it without giving it much thought. Outsiders can see what is going on, though, and that’s why it is such rich material for drama — and comedy, too.

The mining industry is Minnesota’s ne’er-do-well brother-in-law. A couple more examples of why surfaced this week.

About 650 taconite miners are about to run out of unemployment benefits. The governor has called for a special session to consider the extension of those benefits because the mines are still closed.

Dayton wants to help laid-off steelworkers by lengthening the period of eligibility for unemployment benefits beyond the state-mandated 26 weeks.

By the end of October, according to the administration, companies including Minntac, U.S. Steel and Magnetation had laid off an estimated 1,413 workers in response to plunging global steel prices.

Later this month, 74 of those workers will see their weekly benefits expire. Next February and March, an additional 596 workers will lose theirs.

Sen. David Tomassoni, DFL-Chisholm, argued that a longer-than-usual period of unemployment benefits would be appropriate for the steelworkers since many have delayed job searches or retraining in hopes that the mining companies would summon them back to work. [I thought, in fact, that you were supposed to engage in “job searches and retraining” when you were collecting unemployment. ed]

This is just the latest example of why the mining industry is an unreliable boom-and-bust employer and how the consequences of the bust are are visited on the state.

If this is such a good idea, Sen. Tomassoni, why don’t you dip into the Doug Fund’s $150,000,000 you’ve salted away? The Doug Fund, a fund that’s full name is the Douglas J. Johnson Economic Protection Trust Fund, receives a portion of the production taxes collected on mining activity. Mining taxes, the production tax and the “occupation” tax, are heavily skewed toward the production tax, which stays on the Range. The occupation tax does not produce much revenue for the state.

What could be better economic protection than helping 650 unemployed miners out? What do you think, Senator? It sounds like a winner to me.

And now comes the news that Minnesota Power wants to give “electric rate” relief to mines and mills on the Range because of the tough time they are having. Mighty charitable of them. But there is a catch.

Of course.

Minnesota Power — which wants to keep the mines operating because they are big customers — believes that charity begins at home. Specifically, the homes of the residential rate payers served by Minnesota Power.

Struggling northern Minnesota mining companies and paper mills would get a 5 percent break on their electric bills under a rate relief plan that also would drive up residential rates, a Duluth-based utility said Friday.

Residential customers of Minnesota Power would see an increase of 14.5 percent, or about $11.45 per month, based on a typical 750 kilowatt-hours of monthly power use, the utility said. General commercial businesses would see a 4 percent rate hike.

And it doesn’t take much of a trip down memory lane to remember Essar Steel “Minnesota.” You’ll recall that DEED, the economic development people at the state, (along with the IRRRB, which contributed a much smaller amount) ponied up about $70 million to help Essar Steel India build a state-of-the-art taconite plant and steel mill. Great, but there won’t be a steel mill, and now everybody is standing around trying to figure out how the @#$%& the state gets it money back.

Short answer? It won’t. Which is too bad, because Minnesota Power could have sold Essar Steel Minnesota a lot of electricity at residential rate payers’ expense.

I hope, friends, you are beginning to discern the pattern here. It’s a pattern that goes back a very long time. The IRRRB, for instance, was formed in 1941 — before we entered WWII — with the idea that the Range needed to be rehabilitated.

After all of the millions of public money poured into the area since then, name a prosperous Range mining city. Go ahead.

No, my friends, the Range is still not rehabilitated. But soon! One more mine! That’s the ticket!

One of the things that PolyMet touts as an advantage it has over other mining companies is that it got its plant and tailings basin really, really cheap. Well, yes, it did. The taconite mining company that previously owned it, LTV, went bankrupt. (The tailings basin leaks, by the way, which Minnesota Power is on the hook to fix, but that’s a tortured tale for another day.)

It’s bad enough when these duds don’t work out, but it adds insult to injury when they not only go down the drain, but screw up the environment in the process. It’s like paying somebody to throw trash in your yard. It’s exactly like that.

The IRRRB and DEED have already put money into PolyMet. The recent and “final” — well, we will see, won’t we? — environmental impact statement issued a week ago says next to nothing about how PolyMet will pay to clean up its messes, especially after it is dead.

You have a chance to comment on that at the DNR; you have about three weeks to do it. You can also drop a line to Governor Dayton. I urge you to do both.

But in the meantime, friends, when Frank, Jon, Bruce, Brad — or even Jess — and all the rest of your brothers-in-law show up at the front door and ask to crash on the couch, think hard about whether you’ll swing the door wide.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.