Why did a Court of Appeals Judge ask if PolyMet’s dam was a Hail Mary? A reprise

Since the DNR’s dam permits and permit to mine are before the Office of Administrative Hearings this week, I thought it was time to do a reprise of this story from October, 2019.

You might also be interested in On attempts to sell clean water down the river from February, 2020.

It’s more of a Lazarus, really

Is the tailings dam a Hail Mary? That’s what a judge in the Court of Appeals asked the attorney for the DNR at the hearing on the 23rd. Before answering that question, though, let’s go back to October of 2001 and this lede from a press release:

(Duluth, MN)–Minnesota Power, a business of ALLETE, Inc. (NYSE:ALE), and Cleveland-Cliffs Inc (NYSE: CLE) announce that they have executed an Asset Purchase Agreement with LTV to acquire all of the assets of LTV Steel Mining Co. (LTVSMC). The LTVSMC mining operation was closed on Jan. 5, 2001, after LTV initiated a Chapter 11 bankruptcy proceeding. The purchase agreement is subject to approval from the U.S. Bankruptcy Court and satisfaction of other closing conditions.

Cleveland-Cliffs bought the mining assets of LTV, including the taconite processing plant and tailings impoundment at Hoyt Lakes; Allete bought utility generation and distribution assets, including a coal-fired power plant and associated “coal pile” at the late Taconite Harbor. That plant, one of the dirtiest in Minnesota, and the coal pile, too, are gone.

Cleveland-Cliffs is in the taconite mining business in Minnesota and Allete is the parent of Minnesota Power, a northern Minnesota electrical power generator and distributor. A lot of Minnesota Power’s big customers are mining companies.

It became known that there was substantial deferred maintenance and environmental liability arising out of LTV’s operation and (lack of) maintenance of the tailings impoundment – and the Minnesota DNR’s neglect of same – that Cleveland-Cliffs bought, and it sought to discharge that liability in bankruptcy but it could not.

The sale of the crushing plant and tailings impoundment to PolyMet Mining for use in a non-ferrous mine was a godsend to Cleveland-Cliffs and, well, to the DNR, too. But Cleveland-Cliffs took a pretty big haircut. I haven’t seen the agreement, but I believe PolyMet is supposed to take care of the tailings impoundment, or at least kick that can down the road, which is a load off the DNR’s shoulders. It explains in part why the DNR is such a cheerleader for the most dangerous kind of tailings storage: an upstream tailings dam of the type that has suffered three major failures in a handful of years, two in Brazil, and one in Canada in British Columbia, PolyMet’s home. There was actually a fourth one, again in Brazil, in October of this year, a gold mine.

– o O o –

The only real reason that the PolyMet project made sense in the first place is because it bought a cheap crushing plant and leaky tailings basin, and the possibility of expansion of the mine: its “scalability.” That according to Edison Investment; PolyMet was a client of Edison Investment. The quality of the “ore” is really very low.

If you want to know why Glencore/PolyMet, and the DNR, too, cling so tenaciously to the old LTV tailings dam, this is key. It’s what PolyMet bought, and it is fundamental to the economics of PolyMet’s operation.

The governor’s musings that the old tailings dam has a “smaller environmental footprint” than other tailings storage methods are hogwash; they are a reduction sauce of hogwash, spooned generously over the public. Here’s the governor in an August interview with MinnPost’s Walker Orenstein:

And I think what we know is the environmental footprint on the NorthMet project being run by PolyMet, and of course Glencore being the main backer, it’s an existing mine with an existing pit. And the reason for that is it’s less environmental impact, less movement around, less impact on wetland. And the determination was made, and still supported by DNR in the permitting process, that in this instance in this piece of land, it makes more sense to use the tailings dam the way it is.

It only makes more sense if you have bet the farm on it, or you are the DNR looking for somebody to try to cover up your failure to make sure the dam was maintained by LTV.

– o O o –

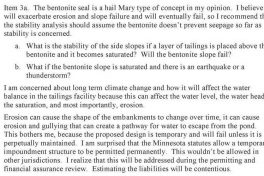

But back to the question: Why is the Glencore/PolyMet tailings dam like a Hail Mary? Well, because a DNR consultant said it was. Here’s consultant Donald Sutton describing the use of a clay liner (bentonite) for the tailings dam:

The dam is a “Hail Mary,” says a DNR consultant Donald Sutton (via polymetpapers.wordpress.com)

He is saying, essentially, that the clay liner would increase the potential for slope saturation and liquefaction of the dam. Sudden and unexpected liquefaction of a tailings dam, also one of the upstream variety, is what happened in Brazil in January and killed almost 250 people.

That was a BIG environmental footprint.

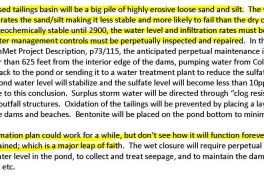

Donald Sutton had some other interesting things to say about the PolyMet tailings dam, which you can read about at the link above. Here’s another quote:

The dam requires a “leap of faith,” says DNR consultant Sutton (via polymetpapers.wordpress.com)

Hail Mary. Leap of faith. Mr. Sutton is a pretty Biblical guy. He’s quotable, too, which I am sure the DNR regrets.

I remember my grandmother and my mother saying, when they believed somebody – including me – was engaged in an act of prevarication, “He’s talking through his hat.” The governor was talking through his hat, or as we would say nowadays, bullshitting.

Addendum: I should have mentioned that the governor’s claim about the mine plan having less impact on wetlands is baloney. With the land swap engineered by Amy Klobuchar and Tina Smith and Pete Stauber, it would be the largest single destruction of wetlands in Minnesota history. You won’t be surprised to know that one is in litigation, too.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.