Public money for public schools

In recent days, there have been complaints on X from Republicans, including legislators, like this one from Jim Schultz, the pious Catholic seminary dropout and unsuccessful candidate for Minnesota Attorney General, also known (by me, anyway) as Father Jimmy. The Republicans think they have a live one here, so you can look forward (?) to him hanging around electoral politics in the future.

In a comment, I asked Schultz where his op-ed was published, since I couldn’t find it. No reply from Father Jimmy. Since I can’t find and read it, I assume that Schultz was writing about the Minnesota Miracle, the revolution in public school finance that occurred under then brand-new governor Wendell Anderson in 1971, about fifty years ago. (He wasn’t really, but it was a useful jumping off point.)

The Minnesota Miracle – In the briefest summary, the Minnesota Miracle shifted a large part of public school finance from local property taxpayers, the traditional source of school funding, to the state.

In a public education tax system that relies on local property taxes to fund local k-12 schools, smaller and rural districts are at a distinct disadvantage, lacking the ‘tax capacity’ of larger and more urban districts.

Wendell Anderson campaigned on the Minnesota Miracle when he ran in 1970. His opponent was Douglas Head, who rejected the idea and called Anderson “Spendy Wendy.” (There really is nothing new under the sun, is there?) Douglas Head was the sitting Attorney General; he ran for governor rather than re-election. Anderson beat Head 54 – 46.

Although it took marathon negotiating and wrangling through the summer of ’71, the Minnesota Miracle was finally passed with bipartisan (a word that modern Republicans cannot pronounce) support.

One of the arguments relied up in support of the Minnesota Miracle was Art. XIII, Sec. 1 of the Minnesota Constitution, which reads:

The stability of a republican form of government depending mainly upon the intelligence of the people, it is the duty of the legislature to establish a general and uniform system of public schools. The legislature shall make such provisions by taxation or otherwise as will secure a thorough and efficient system of public schools throughout the state.

A “general and uniform” system of education wasn’t possible when local property taxes were the principal source of local funding, proponents argued.

When Anderson ran for re-election in 1974, he won all 87 counties. (I think this is the only time that has ever happened.) The Minnesota Miracle was popular, all over the state, even though it raised income and sales taxes.

There were also two property tax elements of the Minnesota Miracle, a “fiscal disparities” law which required the sharing commercial-industrial property tax base increases (still a sore subject in many suburbs), and a uniform statewide general education levy. The education levy was a levy on all real property in the state at a well, uniform rate. The state, not local units of government, distributed the revenue raised to local school districts. But the revenue was dedicated to education.

People think of real estate taxes as regressive — and the are — but the fiscal disparities and statewide general education levies were progressive: they took money from property-rich areas and reallocated it to poorer areas.

The MNopedia article at the link above provides a good account of the consideration of and passage of the Minnesota Miracle.

The beneficiaries of the Minnesota Miracle were intended to be disadvantaged public schools, not private or parochial schools. Father Jimmy has his history screwed up. In fact, Art. XIII, Sec.2 of the Minnesota Constitution is supposed to prevent the support of parochial schools, but the parochial camel’s nose has gotten under the public tent to some degree, as Father Jimmy notes.

As an interesting sidelight, Head kicked off a Republican Party Attorney General drought that has run from 1971 and which will continue at least until until the end of 2026, Jim Schultz notwithstanding. Impressive.

Skeen v. State – A score of years after the Minnesota Miracle, the Minnesota Supreme Court announced its decision in Skeen v. State (1993). In its opinion, the Court held that the state had an affirmative duty to fund a “general and uniform system of public schools.”

Skeen was brought by the parents of city and rural students asserting that the existing school aid formula and the combination of state and local taxes were unconstitutional under the Education Clause. Although the Court affirmed the existence of the duty to fund a “general and uniform system of public schools,” it didn’t find the then current formula to be in violation of it. (The record presented by the Skeen plaintiffs was regrettably thin.)

The seismic change in education finance in 2001 – If you have been reading sleepily along, here is where you need to pay attention.

The uniform statewide general education levy had become, thirty years after it was adopted, really burdensome to property taxpayers, or the taxpayers thought so, anyway. In the second biennium of the Jesse Ventura administration, the general education levy was repealed, and it was to be replaced by state income and sales tax revenue. This was still a fat time in Minnesota, due in part to the management of Governor Arne Carlson from 1991-99. (That’s editorializing a little, I know, but I believe it’s true.)

When the general education levy was eliminated, it turned a stable source of revenue for education into a political football — with entirely predictable results. Minnesota Rep. Tom Rukavina said, and I am paraphrasing now, This will come back to bite us on the ass. And indeed, it did.

If you asked your average suburban city manager if they’d trade the property tax for a jucier sales tax, they would laugh at you. They would laugh at you because sales (and income) taxes are far more volatile than property taxes. What you need to budget for a municipality or a school district is stability and predictability.

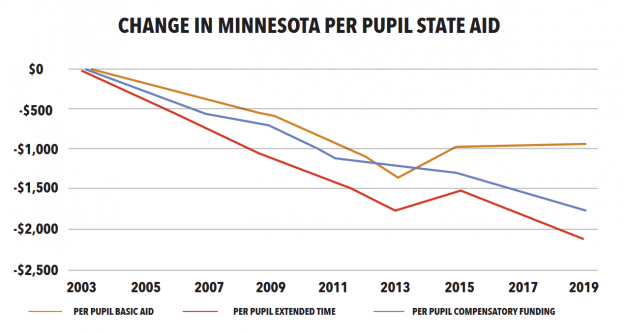

Of course, the fat times of 2001 turned into lean times, and Governor Gutshot — Tim Pawlenty — was elected governor in 2002, ushering in what is called by Minnesota policy wonks the “Lost Decade.” Education funding took it in the shorts, and in some way has never recovered. Here’s a graph from the St. Paul teachers’ union.

It saddens me, dear readers, to tell you this has all been preamble to what this story is really about. It’s 900 words of lede burying. But you can’t understand what braying jerks Republican Father Jimmy Schultz and his fellow travelers are unless you understand this.

The Minnesota Miracle 2.0 – If you notice a small upward blip in per pupil funding the graph above, recognize it was during the time that the DFL last had a trifecta before the one in 2023 – 2025. For every other year depicted, Republicans held at least one house of the legislature and/or the governorship.

In 2023, the DFL had another legislative trifecta, and it set about remedying years — decades, really — of underfunding multiple functions of state government, certainly including education. It didn’t blow a 19 billion dollar surplus; it invested it and spent it on policy priorities. We didn’t lose 19 billion dollars gambling and partying. The state budget can tell you where every dollar went; it wasn’t poured it down a rathole as the sloganeering Father Jimmy suggests.

Now, because of a slowing economy, loss of pandemic funds, and uncertainly surrounding the conduct of the drunken rats in the Trump administration, we have to cut back. And most regrettably, education may have to tighten its belt, too.

If you are going to look for things to cut while trying to maintain the public school mission and directive of Art. XIII, Sec. 1 of the Minnesota Constitution, aid to parochial schools is the first place you should look. Certainly before you reduce per pupil aid to urban and rural districts that really need the money.

Compounding the felony is the fact that Speaker of the House Lisa Demuth said, We’ll balance the budget without new taxes. That includes two genuine no-brainer taxes: one levied on social media companies (all located out of state) based on the number of Minnesota subscriber they have, and another based on sales taxes that would be derived from continuing sales of equipment to several new data centers under consideration. As subsidiaries or affiliates of out-of-state parents, these data centers will be difficult to levy income taxes on, because profit can be allocated elsewhere. Data centers use a lot of the public’s water and employ almost nobody in their operations. Their buildings are essentially large pole barns.

In conclusion, sweet words, I know, don’t let sneering, spittle-flecked, ideologues like Jim Schultz or Lisa Demuth or Harry Niska mislead you into misunderstanding the situation that presents itself on education funding.

§ § §

Update 4/16 – After this story was published on Monday, 4/14, the Minnesota Star Tribune published a story today, 4/16, about the proposed cuts to parochial school aid. It contained a lot of wailing and gnashing of teeth by parochial school advocates. Particularly galling were remarks like this:

And [Principal] Menzhuber of St. John Paul II said her school has made good on the state’s investment: 100% of eighth-graders go on to graduate from high school in four years despite many coming from families on “the margins of society,” she said.

Unremarked on, of course, is the fact that if we supported public schools better, city schools and rural schools could support more programs, and maybe Minneapolis could keep fifth grade band.

Information about parochial school performance is scarce; it is hard to know if Principal Menzhuber’s comment really means anything.

And never forget that schools like John Paul II teach a theology that is antithetical to the rights and interests of the LGBT+ communities, and the rights of women generally. That’s why many of the parents send there kids there. Support for parochial schools undermines the state’s Art. XIII, Sec. 1’s directive and mission.

It is also contrary to Art. XIII, Sec. 2 of the Minnesota Constitution, linked in the story above. Here’s the text:

Prohibition as to Aiding Sectarian School

In no case shall any public money or property be appropriated or used for the support of schools wherein the distinctive doctrines, creeds or tenets of any particular Christian or other religious sect are promulgated or taught.

It was a mistake to go down this road in the first place. Good on Governor Walz and members of the Legislature who want to bring it to a stop. It’s not just the money.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.