A different take on why gas prices have fallen

Even on progressive blogs you’re seeing mostly explanations involving China’s COVID policies, and indicators of recession leading to reduced demand. Stuff like that. While I acknowledge that there are a bunch of factors involved, I think the main ones are often being missed. I need to provide some background before getting to the point.

That gas prices have been being manipulated by Big Oil is flagrantly obvious. From July:

Current prices for oil are running just under $100 per barrel, which is absolutely high. However, it’s less than the price of oil in 2014, or 2013, or 2011. In fact, oil prices actually reached their record high in 2008, when those prices topped $140.

But gas prices in 2008 peaked at $4.10 per gallon. In 2014, which is the last time oil prices are where they are now, the price of gas averaged $3.50. At no point in the period between 2011 and 2015 did gas prices exceed an average of $3.92, even though oil was frequently well above $100 and topped out around $113.Average weekly oil prices topped out around $115 in May, but gas prices this time around climbed to record highs. Not only did gas prices go up more, and go up more quickly, than with previous spikes in the price of oil; as oil prices have dropped, gas prices have been much slower to come back down.

(Daily Kos)

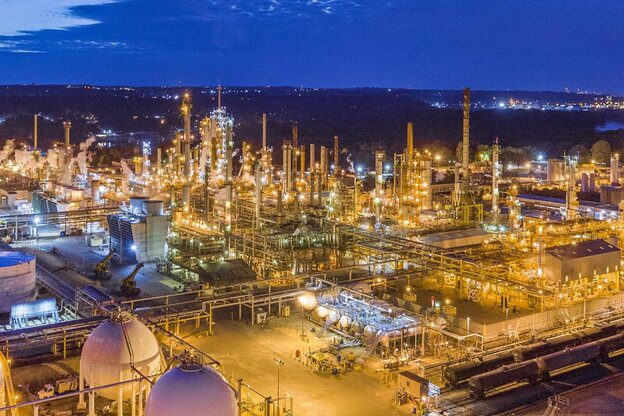

The thing is, it was never fundamentally about crude oil. How much of it was being refined into gasoline was what really mattered.

With gas prices, “everyone goes immediately to the top of the supply chain, at the crude oil level,” said (Diana Moss of the American Antitrust Institute), “or they go to the pump. Nobody looks in the middle of the supply chain for mischief and bad conduct. It’s a problem in energy and health care and food and agriculture. The middle of the supply chain is strategically a place to exercise market power.”

(The American Prospect)

A lot of it was certainly profiteering. But a lot of it was about manipulating public opinion, too. Few things have a more readily apparent inverse relationship than gas prices and presidential job approval numbers. It gets pointed out that there’s actually little that a president can do, when prices spike, but a lot of people reject that claim and I don’t blame them. They did after all get blitzed for months with ads about the glorious greatness that would ensue if this guy got elected, and the hideous awfulness of what would happen if his opponent did.

So, by keeping gas prices high, they were improving the chances of a “red wave” November election. They only in fact got a ripple, but it was enough. With a Party of Trump majority in the House there will be no nonsense about making billionaires pay taxes, etc.

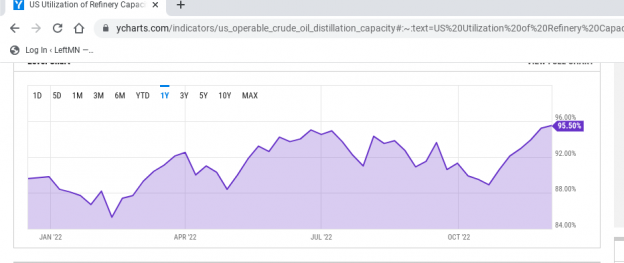

So, let’s look at refinery utilization, now.

See that climb on the right? Why on earth would they do that? Why not keep profiteering to the max? They may still be concerned about possible investigations into price-fixing, which after all could be done by the DOJ, or by states, without having to go through Congress. And they may want to try to improve their public image, a little, for now.

But if you ask me the #1 reason by far is to try to face-plant a big move among the driving public to electric, hybrid, or even to smaller, more fuel-efficient gas-powered vehicles. It’s the big gas-guzzling (and in many cases status symbol) monsters that are most profitable, after all, for both Big Oil and Big Auto. And it’s happening just in time for the Christmas auto/truck advertising/buying season.

Seems obvious to me. Maybe I’m just too cynical.

Thanks for your feedback. If we like what you have to say, it may appear in a future post of reader reactions.